Solar Incentives

Browse by Province/State:

Solar Incentives

Unlocking the power of solar savings, making the transition to renewable energy more accessible than ever and determine if you’re eligible for provincial subsidies that could cover up to 40% of the cost of your project.

(not always correct, please check the numbers as they may change with industry changes)

Solar and your Utility

In Alberta, having solar panels installed means that you can choose your own energy retailer, but you will still be subject to transmission and distribution costs from the company that connected your panels to the grid. To promote consistency, the Alberta government has created "microgeneration" regulations that set the rules for the price of power earned from solar panels. Energy sold to the grid is paid out at a variable rate equivalent to the "Electric Energy Charge" on your bill, typically around $0.08 per kWh. By consuming the solar energy generated by your panels, you can save on transmission, distribution, and rider costs - typically around $0.06 per kWh - for total savings of $0.14 per kWh.

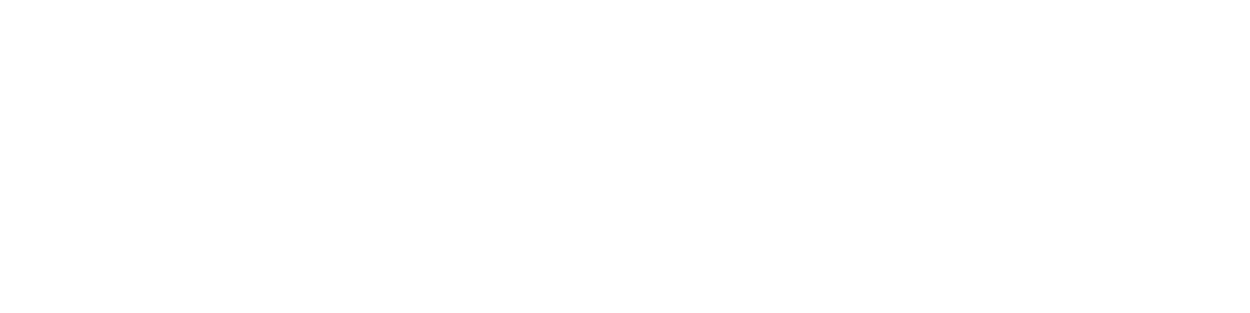

Alberta, solar panels are an excellent investment as the province enjoys the best solar energy resources in the country. For commercial buildings, a 50kW flat roof mount installation in Calgary could produce around 55,000kWh annually (1,100kWh per installed kW). Accounting for the Federal tax deduction under Section 43.2, the estimated cost of the system would be approximately $80,000*.

Assuming a rate of $0.09 per kWh and current inflation trends, the customer could save over $300,000 in expected energy costs over the 30-year lifespan of the system - almost four times the initial system cost ($300,000/$80,000). It's clear that estimating the cost of solar panels is a smart financial decision for businesses in Alberta.

**Please note that these figures are subject to change depending on rebate programs and fluctuating input costs. Contact Local Solar to get the most up-to-date figures.

Incentives

Solar energy is not only good for the environment but also for your wallet, thanks to a range of solar incentives available. Retailers are offering improved crediting rates for solar energy sold back to the grid, up to $0.20 per kWh in some cases. Schools can benefit from a significant rebate for installing solar PV systems as well as providing an approved education component for students.

Meanwhile, the City of Edmonton offers a rebate of $0.40/watt towards residential solar PV installations. Additionally, the Section 43.2 Federal Tax Deduction allows you to depreciate 100% of your solar PV system in the first year against farm or business income. Contact us to learn more about these solar incentives.

Solar and your Utility

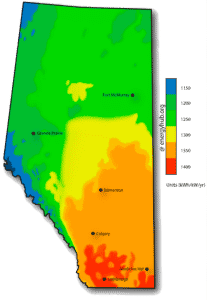

As a solar utility customer of BC Hydro, you can participate in the Net Metering program and receive credit for any excess solar energy that you sell back to the grid at the same rate as the incoming power. This program is tailored for those who generate electricity for their own consumption. When you generate more than you use, you can sell it back to the grid during daytime periods, and when you use more than you generate during evenings and winter periods, you can buy power from the grid. In case you have credits remaining at the anniversary date of joining the program, you will receive a payout at a rate of 9.99 cents per kWh.

When considering solar savings, estimating the cost and potential savings is an important factor to consider. The cost of solar installation depends on several factors, such as the size of the system, the location, and the equipment used. However, with advancements in technology and increased competition in the industry, the cost of solar installation has decreased significantly in recent years. Furthermore, the savings from solar energy are substantial, with many homeowners and businesses experiencing significant reductions in their energy bills. By generating their own electricity, customers with solar energysystems can significantly reduce their reliance on traditional utility companies and their associated costs. Solar savings are not only financial, but also environmental, with solar energy providing a clean and renewable energy source that reduces greenhouse gas emissions. Overall, the potential cost solar savings and environmental benefits of solar make it an attractive option for those looking to reduce their energy costs and promote a more sustainable future.

Incentives

British Columbia offers several solar incentives that can help customers save money on the cost of installing a solar energy system. The PST exemption applies to critical components such as solar photovoltaic modules and inverters sold as part of an energy-producing package. Additionally, Section 43.2 of the Federal Tax Deduction allows for a 100% depreciation of the solar PV system against farm or business income in the first year. By taking advantage of these incentives, customers can reduce the upfront costs of solar installation and enjoy long-term savings. Not only does solar energy help reduce greenhouse gas emissions, but it also supports a clean energy future. With the added benefits of solar incentives, transitioning to renewable energy sources has never been easier or more affordable.

Please note that this can be subject to change depending on rebate programs and fluctuating input costs. Contact Local Solar .to get the most up-to-date figures on solar incentives..

Solar and your Utility

Manitoba Hydro allows customers to generate electricity for their home or business using alternative energy technologies such as solar PV under a Net Billing program. This means that any power you sell to the grid will generate credits at a rate estimated annually by the utility to represent the cost of energy generation for the current grid, typically between $0.03 and $0.05 per kWh.

Any solar energy produced and used onsite will save the customer their full variable rate, so we always encourage customers to use as much power during the day when their systems are operating.

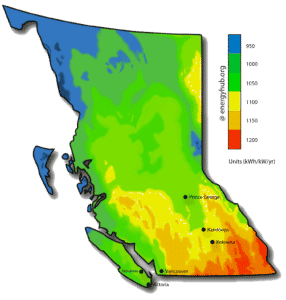

Manitoba has abundant sunshine annually, similar to other prairie provinces such as Alberta and Saskatchewan, which makes it an ideal location for solar energy. In recent years, the use of solar has gained popularity among rural households who require significant energy to power their farming operations and homes.

For instance, let's consider a commercial farm installing a 20kW ground mount system that generates approximately 27,000kWh per year, with an estimated output of 1,350kWh per installed kW. Assuming a 20% income tax rate, the solar system would cost around $43,000 after accounting for the Section 43.2 Federal tax deduction.

Assuming the solar power generated saves the customer $0.07 per kWh, and if energy rates continue to rise at historical averages, this solar system could save the customer over $115,000 in energy costs over the 30-year expected lifespan of the system. That is almost 3 times the cost of the solar system itself ($115,000 / $43,000).

Solar estimating at 20% can help make solar energy more accessible and affordable for customers, and it also provides long-term savings while supporting a clean energy future.

Please note that these figures are subject to change depending on rebate programs and fluctuating input costs. Contact Local Solar to get the most up-to-date figures.

Incentives

Solar incentives can make installing a solar PV system more accessible and affordable for homeowners and businesses. In Canada, there are several solar incentives available that can help reduce upfront costs and provide long-term savings. The Home Energy Efficiency Loan, for example, offers a maximum of $20,000 in loans for solar PV systems with a loan period of up to 15 years at 4.8% interest. Another incentive is the Section 43.2 Federal Tax Deduction, which allows for 100% depreciation of solar PV systems in the first year against farm or business income.

In addition, the Federal Climate Action Incentive Fund (CAIF) Solar Rebate for Small and Medium-sized Enterprises can reimburse incorporated farms and businesses up to 25% of the total cost of implementing GHG-reducing technologies, including solar energy. Although the last funding window has closed, it's expected that the program will continue in the future.

By taking advantage of these solar incentives, customers can reduce their upfront costs and save money in the long run. Moreover, solar energy can help reduce greenhouse gas emissions and support a clean energy future. Overall, solar incentives can make it easier and more affordable for customers to transition to renewable energy sources, and the potential cost and savings of solar make it an attractive option for those looking to invest in clean energy solutions.

Solar and your Utility

Solar energy in Saskatchewan has become increasingly popular in recent years, and for good reason. Under the SaskPower Net Metering Program, customers can sell any excess solar energy they generate to the grid for a rate of $0.075/kWh for systems up to 100kW DC. This means that not only can customers reduce their energy bills, but they can also earn money by producing their own clean energy.

Furthermore, customers can save even more money by using the solar energy they generate onsite. By doing so, they can avoid paying the normal retail rate, which is close to $0.15 per kWh including the carbon tax for residential customers.

If you're interested in installing a solar energy system in Saskatchewan, it's worth looking into the various solar incentives available to help offset the upfront costs. With incentives like the Federal Climate Action Incentive Fund (CAIF) Solar Rebate for Small and Medium-sized Enterprises and the Section 43.2 Federal Tax Deduction, customers can reduce their costs by up to 20%. By taking advantage of these incentives and the net metering program, customers can not only save money, but also contribute to a cleaner and more sustainable energy future.

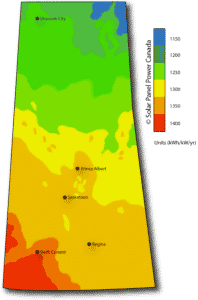

Saskatchewan's high solar irradiance and favorable rates for exporting solar energy make it a promising location for renewable investments. Let's consider the example of a 30kW ground mount installation on a commercial farm that could generate approximately 40,500kWh per year (1,350kWh per installed kW). Assuming a farm income tax rate of 20%, the system would cost around $65,000 after accounting for the Section 43.2 Federal tax deduction.

If the solar power generated offsets customer usage at an average rate of $0.10 per kWh and the rate of inflation continues on its current trajectory, this could result in savings of over $250,000 in expected solar energy costs over the 30-year estimated lifespan of the system. That's almost four times the cost of the system itself ($250,000 / $65,000). With solar estimation and savings like this, it's clear that investing in solar energy can be a smart and cost-effective choice for businesses and farms in Saskatchewan.

Please note that these figures are subject to change depending on rebate programs and fluctuating input costs. Contact Local Solar to get the most up-to-date figures.

Incentives

By choosing to invest in

solar

power, not only will you save money on your energy bills, but you'll also be playing a critical role in protecting the environment. In British Columbia, critical components of a

solar energy system such as solar panels and inverters are PST exempt when they are sold as part of a package to produce energy.

Additionally, as of 2018, you can take advantage of the Section 43.2 Federal Tax Deduction, which allows you to fully depreciate your

solar

PV system in the first year against farm or business income. This means that by going

solar, you can not only reduce your environmental impact but also take advantage of tax benefits.

More Solar Incentives

Hi there! Looking for more incentives? There is alot. Read below.